A friend of mine introduced me to something called momentum trading (also called swing trading) today and it is a pretty interesting concept. So for a quick background, there are two types of trading: swing and trend. Trend is when you are hoping that a stock would go in one direction, either up or down, over a period of time. Swing is when you are hoping the stock will just oscillate in both directions and not really go anywhere. Hence, in bear and bull market extremes, it is wiser to use a trend strategy since the stocks will tend to follow a directional trend. The key challenge with swing trading is to accurately define the market when it is going “nowhere.” This is tough.

However, an industry that came to my mind immediately after hearing this was biotechnology. I have noticed that several biotech company stocks either oscillate continuously or stay near the baseline, going “nowhere.” The reason being that many biotech companies are in the clinical trials and research phase for 5-10 years before releasing their drug. That being said, I wonder if the swing trading approach would work more often than not for the biotech industry…

Sunday, November 2, 2008

Wednesday, October 8, 2008

From basketball to random walk theory

I was watching the 76ers game the other day and heard something in the background commentary that caught my attention. Something along the lines of… the probability of an NBA player of making a shot does not depend on whether he made the shot before that. That claim basically said the “hot hand” was irrelevant when betting on whether a player would make their next shot. To me, that claim seemed like total crap. Apparently, upon researching this a little further after the game, I learned that there was a study done on the 76ers regarding this issue which concluded that there was no correlation between past shots’ influence on future shots.

I realized that this theory was also related to the random walk theory, originally proposed Burton Malkiel in 1973 to explain stock price fluctuation in financial markets. This really got me interested. I’m not going to go into much detail but basically what this theory suggested (based on a coin flipping experiment conducted by Malkiel) is that the fluctuation in stock prices are completely random due to the efficiency of the market.

Though some economists continue to believe in this theory to this day, I feel that there are three things fundamentally wrong with this claim:

I realized that this theory was also related to the random walk theory, originally proposed Burton Malkiel in 1973 to explain stock price fluctuation in financial markets. This really got me interested. I’m not going to go into much detail but basically what this theory suggested (based on a coin flipping experiment conducted by Malkiel) is that the fluctuation in stock prices are completely random due to the efficiency of the market.

Though some economists continue to believe in this theory to this day, I feel that there are three things fundamentally wrong with this claim:

- Efficiency of market – there is a subtle claim in Malkiel’s theory which is that stock prices fluctuate randomly “due to the efficiency of the market.” But is the market completely efficient? I don’t believe so. You have government intervention bailing out the banks, time-lags, and significant human involvement (though many things are now becoming algorithmic driven), all three of which contribute to inefficiencies. Thus, Malkiel’s theory has some holes in its assumptions.

- Market vs. Individual stocks – this is akin to the difference between the entire NBA vs. an individual player on the court. From what I understand, Malkiel’s theory applies to the NBA (the market), and so does the shot percentages research conducted with no correlation. But Statistics 101 says averaging data, and drawing more and more general correlations masks individualized data, which might give a whole new story. Perhaps random walk theory can suggest predicting market movement is impossible as it is random, but it cannot say predicting an individual stock’s movement is random. Similarly, the research on basketball shots combined data from the NBA and hence can apply to the NBA but not the Kobe Bryant’s or Michael Jordan’s of the world.

- Present Day Wall Street – present day Wall Street makes the money on the individual stock, the individual player. And the trillions of dollars to be made in the financial industry clearly shed light on the fact that trades are not random. Otherwise, people would not be in this industry. There is clearly intelligence involved in using the large amounts of data, sorting out the relevant bits, and drawing conclusions – betting on IPOs, arbitrage trading, momentum trading are relevant examples. Though there is always an element of uncertainty and luck, it doesn’t govern the process but instead just plays a role.

Thursday, September 18, 2008

Taking advantage of over-hyped IPOs

So I was reading about startup IPOs – when a company first offers company stock to the public – the other day. This process has some interesting points: first, I’ve noticed that many of these companies try to create massive amounts of hype prior to their IPO to attract many buyers, making the stock price increase rapidly in the initial phases. But when I looked at the data of many of the stock prices six months later, most of them decreased back down do an equilibrium point with market forces kicking in.

There are several reasons why this could have occurred: once the company declares itself public, it is mandated to share its future vision, finances, and all other sorts of data, making the company vulnerable to all types of financial calculations and estimates from traders globally. This naturally allows the market to dictate the price, rather than external influences that over-hype the stock initially. Another reason, which is less subtle, is that the management team, investors, and founders usually agree to a clause which prevents them from selling any of their equity for six months after the IPO. This prevents any startup founder or high stake holder to sell their entire stock, giving the company a horrible image in the market. But after six months, more often than not, several founders and high-stake holders invariably sell part of their stock, liquidating some of their assets, allowing them to gain more financial security. Since any stake-holder selling their stock after an IPO is a bad signal, the trend mentioned above may potentially help lower market estimates of the stock’s worth.

But now, the key question is: despite the above trends, why do buyers continue to purchase stock in the very beginning of the IPO, when the stock is severely over-hyped? Wouldn’t it be wiser to short sell the stock in the initial week and make money off the equilibration phase that takes place over the next few months? And THEN, if the company shows promise, buy the stock after the equilibration price is attained?

Would love to hear your thoughts.

There are several reasons why this could have occurred: once the company declares itself public, it is mandated to share its future vision, finances, and all other sorts of data, making the company vulnerable to all types of financial calculations and estimates from traders globally. This naturally allows the market to dictate the price, rather than external influences that over-hype the stock initially. Another reason, which is less subtle, is that the management team, investors, and founders usually agree to a clause which prevents them from selling any of their equity for six months after the IPO. This prevents any startup founder or high stake holder to sell their entire stock, giving the company a horrible image in the market. But after six months, more often than not, several founders and high-stake holders invariably sell part of their stock, liquidating some of their assets, allowing them to gain more financial security. Since any stake-holder selling their stock after an IPO is a bad signal, the trend mentioned above may potentially help lower market estimates of the stock’s worth.

But now, the key question is: despite the above trends, why do buyers continue to purchase stock in the very beginning of the IPO, when the stock is severely over-hyped? Wouldn’t it be wiser to short sell the stock in the initial week and make money off the equilibration phase that takes place over the next few months? And THEN, if the company shows promise, buy the stock after the equilibration price is attained?

Would love to hear your thoughts.

Tuesday, August 26, 2008

Wall Street and MIT

One in every three people I meet at MIT are into finance in some way or the other. Some are in market research and investment banking and others are in sales and trading... seems like making big bucks on Wall Street is the central goal for many MIT undergrads. And working at JP Morgan, Goldman, and hedge funds seem like the "hot" things to do over the summer.

I come from a background of high-tech and am fascinated by next-generation web technologies, nanotechnology, AI, and the fusion of neuroscience and computers. Frankly, I have never really considered finance as potential career path. I did write some business plans and financial statements back in high school and also participated in virtual stock market games, but didn't seem to find enough time to devote to learning the ins and outs of the financial industry at that time.

Regardless of my background, however, I feel that I should make best use of this opportunity and culture and learn more about finance and how engineering can be applied to this industry. Who knows, I might get really into this stuff? And worst case, these concepts are essential to know anyways, no matter what industry I go into.

I come from a background of high-tech and am fascinated by next-generation web technologies, nanotechnology, AI, and the fusion of neuroscience and computers. Frankly, I have never really considered finance as potential career path. I did write some business plans and financial statements back in high school and also participated in virtual stock market games, but didn't seem to find enough time to devote to learning the ins and outs of the financial industry at that time.

Regardless of my background, however, I feel that I should make best use of this opportunity and culture and learn more about finance and how engineering can be applied to this industry. Who knows, I might get really into this stuff? And worst case, these concepts are essential to know anyways, no matter what industry I go into.

Wednesday, July 2, 2008

My Story with Powerset

Ever heard of Powerset? It is a private startup I have been following for several months now. It has come up with potentially disruptive search technology based on natural language processing. This basically means that their search engine has more advanced capabilities to actually unlock the meaning encoded in ordinary human language. This seems several steps ahead of mere keyword search which Google offers. In fact, recently Powerset launched a test drive of their search technology based on Wikipedia articles. Check it out at www.powerset.com.

Anyways, in addition to Powerset's technological innovations, its team has captured my interest as well, namely its Founder & CTO, Barney Pell. I have managed to schedule a meeting with him in mid-August 2008 to discuss the future of Powerset and any advice he has for students like me planning to enter the business & technology industry. Ever since, I have been counting down days to the meeting with great anticipation. I can't wait!!

And, TODAY, I learned something that seriously made me fall of my chair. Microsoft just acquired Powerset. Wow! A company that I have been following for months with excitement has, within a day, transformed from an independent self-sustaining entity to another division within the Microsoft Live Search team...though I can definitely see advantages of making this acquisition (the abundance of resources Live Search offers, for one) I am afraid that Powerset's dynamic start-up culture and independent thinking may be compromised in the process.

More fascinating to me, however, is how fast things can change in the world of business, especially in the business of technology where the tech governs the marketplace! I will continue to follow Powerset and am keen to see how it progresses from today onwards. Plus, this will provide me with interesting talking points with Mr. Pell in August :)

Anyways, in addition to Powerset's technological innovations, its team has captured my interest as well, namely its Founder & CTO, Barney Pell. I have managed to schedule a meeting with him in mid-August 2008 to discuss the future of Powerset and any advice he has for students like me planning to enter the business & technology industry. Ever since, I have been counting down days to the meeting with great anticipation. I can't wait!!

And, TODAY, I learned something that seriously made me fall of my chair. Microsoft just acquired Powerset. Wow! A company that I have been following for months with excitement has, within a day, transformed from an independent self-sustaining entity to another division within the Microsoft Live Search team...though I can definitely see advantages of making this acquisition (the abundance of resources Live Search offers, for one) I am afraid that Powerset's dynamic start-up culture and independent thinking may be compromised in the process.

More fascinating to me, however, is how fast things can change in the world of business, especially in the business of technology where the tech governs the marketplace! I will continue to follow Powerset and am keen to see how it progresses from today onwards. Plus, this will provide me with interesting talking points with Mr. Pell in August :)

Labels:

Business,

Natural Language,

Networking,

Search,

Technology

Monday, June 23, 2008

IPTV and Consumer-Controlled Advertising

Recently, I came across a video where I saw Vint Cerf, VP and Chief Internet Evangelist at Google, talk about the future of IPTV and consumer-controlled advertising. I was intrigued to learn what he had to say.

Essentially, the whole idea of consumers initiating the entire advertising experience and the technology automatically being there to facilitate consumer's curiosity about a product they see is something new. Today, we are bombarded with links, banners, and all sorts of ads that don't really apply to our lives. We have habitually learned to ignore them, so even when they MIGHT help us find what we are looking for, we subconsciously choose to ignore them based on past experience. So the first step is to make ads seem as either relevant or not-clutter in the eyes of consumers. Product placement achieves this by embedding the ads INTO what we consider "important" and as a result, the ads were no longer seen as mere clutter. This way, we don't simply ignore them. Cerf's insights go one step further: in addition to us not ignoring them, we will also see these product placement ads as reliable entry points into the consumer shopping realm. We will be able to take our initial reactions of "Oh that laptop is nice..." or "Cool mp3 player" to the next level by seeing the specs, price ranges, and customer reviews, etc... simply with a press of a button (or touch to the screen!) And the best part is WE will initiate the entire process, and in the future, technology will be set in place to facilitate this.

With technologies like TIVO and consumers simply fast-forwarding through ads in online videos, product placement is becoming more and more popular. Fusing this concept with the seamless touch-screen based human-computer interaction could completely change the way consumers interact with advertising.

Essentially, the whole idea of consumers initiating the entire advertising experience and the technology automatically being there to facilitate consumer's curiosity about a product they see is something new. Today, we are bombarded with links, banners, and all sorts of ads that don't really apply to our lives. We have habitually learned to ignore them, so even when they MIGHT help us find what we are looking for, we subconsciously choose to ignore them based on past experience. So the first step is to make ads seem as either relevant or not-clutter in the eyes of consumers. Product placement achieves this by embedding the ads INTO what we consider "important" and as a result, the ads were no longer seen as mere clutter. This way, we don't simply ignore them. Cerf's insights go one step further: in addition to us not ignoring them, we will also see these product placement ads as reliable entry points into the consumer shopping realm. We will be able to take our initial reactions of "Oh that laptop is nice..." or "Cool mp3 player" to the next level by seeing the specs, price ranges, and customer reviews, etc... simply with a press of a button (or touch to the screen!) And the best part is WE will initiate the entire process, and in the future, technology will be set in place to facilitate this.

With technologies like TIVO and consumers simply fast-forwarding through ads in online videos, product placement is becoming more and more popular. Fusing this concept with the seamless touch-screen based human-computer interaction could completely change the way consumers interact with advertising.

Saturday, June 21, 2008

Connecting Mind and Machine

I was browsing through the web today, and came across this fascinating article by Forbes.

I genuinely believe this is the next big advancement in human computer interaction, impacting our day-to-day lives at a very large scale. As we immerse our lives with technology each day, there is a constantly growing need to make all the clutter more manageable and easier to use!

As a prospective for an Electrical Engr/Computer Sci and Brain/Cognitive Sci major combination at MIT, seeing this kind of exciting research being done in this area really inspires me to learn as much as I can about the field.

Sunday, February 10, 2008

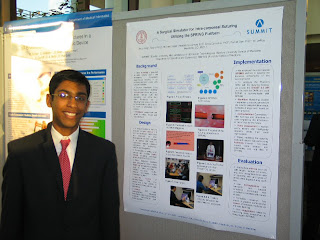

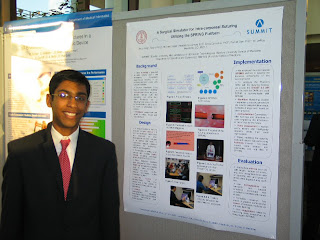

Presentation at Medicine Meets Virtual Reality 16 Conference, Long Beach, CA

Presenting at MMVR was an awesome experience. I got an opportunity to meet scientists, engineers, and business executives from all across the world and from different industries. In the process, I exchanged business cards, and collected numerous opinions and comments on my research. And of course, being the only high school student at the conference, I had to explain my personal story several times of how I ended up getting an opportunity to present at this conference.

More than showcasing my work, I enjoyed looking at neat stuff others had been working on. One particular project that was especially interesting was a new method to simulate blood clotting and bleeding in intensive surgeries. Simulating bleeding accurately has been a challenge for years and it was very exciting to observe the ‘particle’ method of simulating the same.

More than showcasing my work, I enjoyed looking at neat stuff others had been working on. One particular project that was especially interesting was a new method to simulate blood clotting and bleeding in intensive surgeries. Simulating bleeding accurately has been a challenge for years and it was very exciting to observe the ‘particle’ method of simulating the same.

I loved the energetic atmosphere, the ecosystem of knowledge constantly being improved, and the warm reception I received, being a high school senior.

I had realized the future potential of virtual reality and digitizing the five human senses back in 2005, when I came across several online articles revolving around these issues. I remember it like it was yesterday. I was browsing through the Medicine Meets Virtual Reality (MMVR) 14 conference proceedings when I came across a name that continues to resonate in my mind today – Stanford University SUMMIT. Apparently, they seemed to have quite a popular showing at the annual MMVR conferences. Completely blown away with their work on surgical robotics and realizing that they had their research labs only a few miles away from my home, I reached out to them immediately and voiced my interests in implementing some ideas I had been entertaining in my mind.

Before I knew it, I was selected as a high school intern in February of 2007 and have been actively conducting research in augmented user-learning systems and surgical feedback interfaces since. I have just returned from Long Beach, CA where I presented my research at the same conference which originally plunged me into this adventure – Medicine Meets Virtual Reality 16.

I cannot wait till next year’s conference and am eagerly looking forward to it!

More than showcasing my work, I enjoyed looking at neat stuff others had been working on. One particular project that was especially interesting was a new method to simulate blood clotting and bleeding in intensive surgeries. Simulating bleeding accurately has been a challenge for years and it was very exciting to observe the ‘particle’ method of simulating the same.

More than showcasing my work, I enjoyed looking at neat stuff others had been working on. One particular project that was especially interesting was a new method to simulate blood clotting and bleeding in intensive surgeries. Simulating bleeding accurately has been a challenge for years and it was very exciting to observe the ‘particle’ method of simulating the same.I loved the energetic atmosphere, the ecosystem of knowledge constantly being improved, and the warm reception I received, being a high school senior.

I had realized the future potential of virtual reality and digitizing the five human senses back in 2005, when I came across several online articles revolving around these issues. I remember it like it was yesterday. I was browsing through the Medicine Meets Virtual Reality (MMVR) 14 conference proceedings when I came across a name that continues to resonate in my mind today – Stanford University SUMMIT. Apparently, they seemed to have quite a popular showing at the annual MMVR conferences. Completely blown away with their work on surgical robotics and realizing that they had their research labs only a few miles away from my home, I reached out to them immediately and voiced my interests in implementing some ideas I had been entertaining in my mind.

Before I knew it, I was selected as a high school intern in February of 2007 and have been actively conducting research in augmented user-learning systems and surgical feedback interfaces since. I have just returned from Long Beach, CA where I presented my research at the same conference which originally plunged me into this adventure – Medicine Meets Virtual Reality 16.

I cannot wait till next year’s conference and am eagerly looking forward to it!

Subscribe to:

Comments (Atom)